Semiconductor Metrology Equipment Manufacturing in 2025: Navigating Precision, Innovation, and Explosive Market Growth. Discover How Advanced Metrology is Shaping the Next Era of Semiconductor Excellence.

- Executive Summary: Key Findings and Market Highlights

- Market Overview: Defining Semiconductor Metrology Equipment Manufacturing

- 2025 Market Size and Growth Forecast (2025–2030): 8% CAGR and Revenue Projections

- Key Growth Drivers: AI, EUV Lithography, and Advanced Packaging

- Competitive Landscape: Major Players and Emerging Innovators

- Technology Trends: In-Line Metrology, Machine Learning, and Automation

- Regional Analysis: Asia-Pacific, North America, and Europe Market Dynamics

- Challenges and Barriers: Supply Chain, Cost Pressures, and Technical Hurdles

- Customer Segments and End-Use Applications

- Future Outlook: Disruptive Technologies and Strategic Opportunities (2025–2030)

- Conclusion and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings and Market Highlights

The semiconductor metrology equipment manufacturing sector is poised for robust growth in 2025, driven by the escalating complexity of semiconductor devices and the ongoing transition to advanced process nodes such as 3nm and below. As chipmakers push the boundaries of miniaturization, the demand for precise measurement and inspection tools has intensified, making metrology equipment a critical enabler of yield improvement and process control.

Key findings indicate that leading manufacturers are investing heavily in R&D to develop next-generation metrology solutions capable of addressing challenges in extreme ultraviolet (EUV) lithography, 3D NAND, and advanced packaging. Companies such as KLA Corporation, ASML Holding N.V., and Hitachi High-Tech Corporation continue to dominate the market, leveraging their technological expertise and global customer base.

Market highlights for 2025 include:

- Increased Adoption of AI and Automation: Integration of artificial intelligence and machine learning algorithms into metrology systems is enhancing defect detection accuracy and throughput, as seen in recent product launches by KLA Corporation and Hitachi High-Tech Corporation.

- Growth in Advanced Packaging Metrology: The rise of heterogeneous integration and chiplet architectures is fueling demand for metrology tools tailored to advanced packaging, with ASML Holding N.V. and KLA Corporation expanding their offerings in this segment.

- Geographical Shifts in Manufacturing: Ongoing investments in semiconductor fabs in Asia, the United States, and Europe—supported by government incentives—are reshaping the global supply chain and creating new opportunities for equipment suppliers, as highlighted by initiatives from Taiwan Semiconductor Manufacturing Company Limited (TSMC) and Intel Corporation.

- Focus on Sustainability: Manufacturers are increasingly prioritizing energy efficiency and resource optimization in metrology tool design, aligning with broader industry sustainability goals.

In summary, the semiconductor metrology equipment manufacturing market in 2025 is characterized by rapid technological innovation, strategic investments, and a dynamic competitive landscape, positioning it as a cornerstone of the semiconductor industry’s continued advancement.

Market Overview: Defining Semiconductor Metrology Equipment Manufacturing

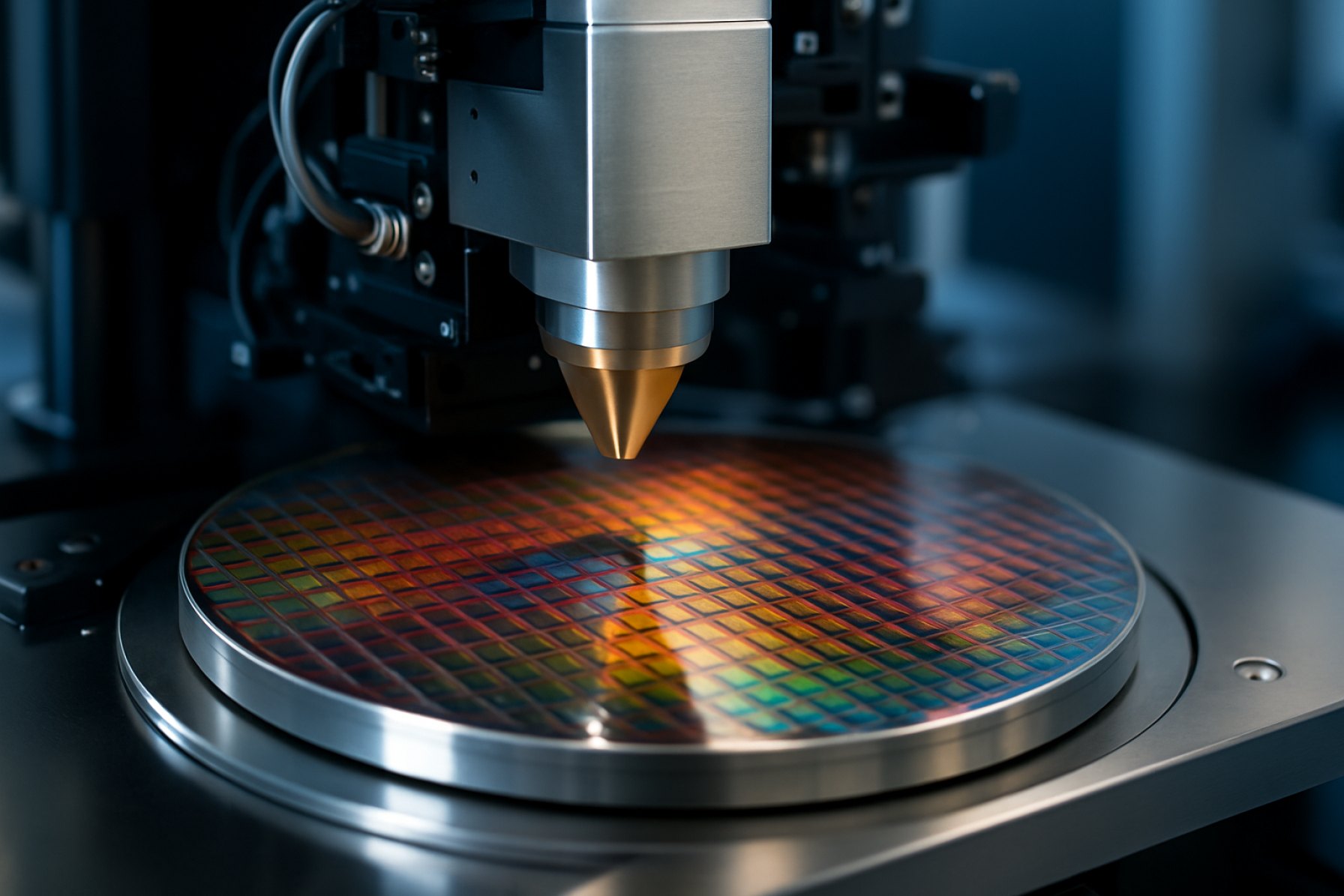

Semiconductor metrology equipment manufacturing is a specialized segment within the broader semiconductor industry, focused on the design, production, and supply of tools that measure and analyze the physical and electrical properties of semiconductor wafers and devices. These tools are essential for ensuring the precision, quality, and yield of semiconductor fabrication processes, particularly as device geometries continue to shrink and process complexity increases. The market for semiconductor metrology equipment is driven by the ongoing demand for advanced integrated circuits in applications such as consumer electronics, automotive, telecommunications, and data centers.

Key players in this market include established equipment manufacturers such as KLA Corporation, ASML Holding N.V., and Hitachi High-Tech Corporation, all of which provide a range of metrology solutions for critical process steps like lithography, etching, and deposition. These companies invest heavily in research and development to address the challenges posed by advanced nodes, such as 3nm and below, where precise measurement of features at the atomic scale is required.

The market landscape is shaped by rapid technological advancements, including the adoption of artificial intelligence and machine learning for data analysis, as well as the integration of metrology systems with process control software. This integration enables real-time monitoring and feedback, which is crucial for maintaining high yields and reducing manufacturing costs. Additionally, the transition to new materials and device architectures, such as 3D NAND and gate-all-around (GAA) transistors, is fueling demand for next-generation metrology solutions.

Geographically, the Asia-Pacific region dominates the semiconductor metrology equipment market, driven by significant investments in semiconductor manufacturing capacity in countries like Taiwan, South Korea, and China. Major foundries and integrated device manufacturers, including Taiwan Semiconductor Manufacturing Company Limited (TSMC) and Samsung Electronics Co., Ltd., are key customers for metrology equipment suppliers.

Looking ahead to 2025, the semiconductor metrology equipment manufacturing market is expected to experience robust growth, propelled by the continued scaling of semiconductor devices, the proliferation of advanced packaging technologies, and the expansion of global chip production capacity. The sector’s evolution will remain closely tied to the pace of innovation in semiconductor fabrication and the industry’s ability to address emerging measurement challenges.

2025 Market Size and Growth Forecast (2025–2030): 8% CAGR and Revenue Projections

The semiconductor metrology equipment manufacturing sector is poised for robust expansion in 2025, driven by escalating demand for advanced process control and quality assurance in semiconductor fabrication. According to industry projections, the global market size for semiconductor metrology equipment is expected to reach approximately $5.2 billion in 2025. This growth is underpinned by the proliferation of advanced nodes (5nm, 3nm, and below), the adoption of EUV lithography, and the increasing complexity of device architectures such as 3D NAND and FinFETs.

From 2025 to 2030, the market is forecasted to grow at a compound annual growth rate (CAGR) of around 8%. This sustained growth trajectory is attributed to several factors, including the ongoing miniaturization of semiconductor devices, the integration of artificial intelligence and machine learning in metrology solutions, and the expansion of foundry and memory manufacturing capacities worldwide. Leading manufacturers such as KLA Corporation, ASML Holding N.V., and Hitachi High-Tech Corporation are investing heavily in R&D to develop next-generation metrology tools capable of meeting the stringent requirements of sub-3nm process technologies.

Revenue projections for the period indicate that the market could surpass $7.6 billion by 2030, reflecting both organic growth and the introduction of innovative metrology platforms. The Asia-Pacific region, led by Taiwan, South Korea, and China, is expected to remain the largest and fastest-growing market, fueled by aggressive investments in semiconductor manufacturing infrastructure and government-backed initiatives to achieve technological self-sufficiency. North America and Europe will also see steady growth, supported by the expansion of domestic chip production and strategic partnerships between equipment suppliers and integrated device manufacturers.

Key growth segments within the metrology equipment market include optical and e-beam inspection systems, overlay metrology, and critical dimension (CD) measurement tools. The increasing adoption of in-line and real-time metrology solutions is further enhancing yield management and process optimization across the semiconductor value chain. As the industry moves toward the era of heterogeneous integration and advanced packaging, the demand for highly precise and automated metrology equipment is expected to intensify, reinforcing the sector’s positive outlook through 2030.

Key Growth Drivers: AI, EUV Lithography, and Advanced Packaging

The semiconductor metrology equipment manufacturing sector is experiencing robust growth, propelled by three primary technological drivers: artificial intelligence (AI), extreme ultraviolet (EUV) lithography, and advanced packaging. Each of these factors is reshaping the requirements and opportunities for metrology toolmakers as the industry moves toward ever-smaller nodes and more complex device architectures.

AI is accelerating demand for high-performance chips, which in turn necessitates tighter process control and higher yields. As chip designs become more intricate, metrology equipment must deliver greater precision and throughput to monitor critical dimensions, overlay, and material properties at the nanoscale. Leading manufacturers such as KLA Corporation and Hitachi High-Tech Corporation are integrating AI-driven analytics into their metrology platforms, enabling real-time defect detection and process optimization.

EUV lithography, now essential for sub-7nm and sub-5nm nodes, introduces new challenges in pattern fidelity and defectivity. The adoption of EUV by major foundries has spurred demand for metrology tools capable of measuring features at atomic scales and inspecting EUV-specific defects. Companies like ASML Holding N.V. are not only supplying EUV scanners but also collaborating with metrology specialists to ensure comprehensive process control throughout the EUV workflow.

Advanced packaging technologies, such as 2.5D/3D integration and chiplet architectures, are driving a paradigm shift in metrology requirements. These approaches demand precise measurement of interconnects, through-silicon vias (TSVs), and heterogeneous material interfaces. Equipment manufacturers are responding with new solutions for non-destructive, high-resolution inspection and metrology tailored to complex package structures. Tokyo Seimitsu Co., Ltd. and Onto Innovation Inc. are among the companies expanding their portfolios to address these needs.

In summary, the convergence of AI, EUV lithography, and advanced packaging is catalyzing innovation in semiconductor metrology equipment manufacturing. The sector’s growth in 2025 will be closely tied to the ability of toolmakers to deliver solutions that meet the evolving demands of next-generation semiconductor production.

Competitive Landscape: Major Players and Emerging Innovators

The competitive landscape of semiconductor metrology equipment manufacturing in 2025 is characterized by a blend of established industry leaders and agile emerging innovators. The sector is critical for ensuring the precision and quality control required in advanced semiconductor fabrication, with metrology tools enabling the measurement and analysis of features at the nanometer scale.

Among the dominant players, KLA Corporation continues to hold a significant market share, leveraging its comprehensive portfolio of inspection and metrology systems. KLA’s solutions are widely adopted for process control in both front-end and back-end semiconductor manufacturing, and the company’s ongoing investment in AI-driven analytics and e-beam inspection technologies further cements its leadership.

Another key competitor, ASML Holding N.V., is renowned for its lithography systems but has also expanded its metrology offerings, particularly in the context of extreme ultraviolet (EUV) lithography. ASML’s metrology tools are tightly integrated with its lithography platforms, providing customers with end-to-end process optimization.

Hitachi High-Tech Corporation and Tokyo Electron Limited are also prominent, especially in the electron microscopy and critical dimension measurement segments. Both companies have focused on enhancing throughput and accuracy to meet the demands of sub-5nm process nodes.

Emerging innovators are increasingly shaping the competitive dynamics. Companies such as Onto Innovation Inc. (formed from the merger of Nanometrics and Rudolph Technologies) are gaining traction with advanced optical metrology and defect inspection solutions tailored for heterogeneous integration and advanced packaging. Startups and smaller firms are also making inroads, particularly in niche areas like in-line metrology for compound semiconductors and AI-powered defect classification.

Strategic partnerships and acquisitions are common, as established players seek to integrate novel technologies and expand their capabilities. The competitive landscape is further influenced by regional initiatives, with governments in the US, Europe, and Asia supporting domestic metrology tool development to bolster supply chain resilience.

In summary, the semiconductor metrology equipment manufacturing sector in 2025 is marked by intense competition, rapid innovation, and a dynamic interplay between global giants and specialized newcomers, all striving to address the escalating complexity of semiconductor devices.

Technology Trends: In-Line Metrology, Machine Learning, and Automation

The semiconductor metrology equipment manufacturing sector is undergoing rapid transformation, driven by the integration of in-line metrology, machine learning, and automation. These technology trends are reshaping how manufacturers ensure process control, yield optimization, and cost efficiency in semiconductor fabrication.

In-line metrology is increasingly replacing traditional offline measurement methods. By embedding metrology tools directly into production lines, manufacturers can perform real-time monitoring and control of critical parameters such as film thickness, critical dimension (CD), and overlay. This shift enables immediate detection of process deviations, reducing scrap rates and improving overall yield. Leading equipment providers, such as KLA Corporation and ASML Holding N.V., are developing advanced in-line metrology systems that integrate seamlessly with high-volume manufacturing environments.

Machine learning (ML) is another transformative force in metrology equipment. By leveraging large datasets generated during wafer inspection and measurement, ML algorithms can identify subtle patterns and predict process drifts before they impact device performance. This predictive capability allows for proactive process adjustments, minimizing downtime and enhancing throughput. Companies like Applied Materials, Inc. are incorporating AI and ML into their metrology platforms to enable smarter, adaptive process control.

Automation is further amplifying the benefits of in-line metrology and machine learning. Automated material handling systems, robotic wafer transport, and software-driven recipe management are reducing human intervention, increasing repeatability, and lowering the risk of contamination. The integration of metrology data with factory automation systems enables closed-loop control, where process corrections are implemented in real time based on measurement feedback. Hitachi High-Tech Corporation and Tokyo Seimitsu Co., Ltd. are among the manufacturers advancing automation in metrology equipment.

Looking ahead to 2025, the convergence of in-line metrology, machine learning, and automation is expected to be a defining trend in semiconductor metrology equipment manufacturing. These technologies are essential for supporting the continued scaling of device geometries, the adoption of new materials, and the increasing complexity of semiconductor devices, ensuring that manufacturers can meet the stringent quality and productivity demands of next-generation chip production.

Regional Analysis: Asia-Pacific, North America, and Europe Market Dynamics

The semiconductor metrology equipment manufacturing sector is experiencing distinct market dynamics across the Asia-Pacific, North America, and Europe regions as of 2025. Each region’s trajectory is shaped by its technological capabilities, government policies, and the presence of leading semiconductor manufacturers.

Asia-Pacific remains the dominant force in semiconductor metrology equipment manufacturing, driven by the concentration of major foundries and integrated device manufacturers in countries such as Taiwan, South Korea, Japan, and China. The region benefits from robust investments in advanced process nodes and the rapid expansion of fabrication facilities. Governments in the region, notably through initiatives like China’s “Made in China 2025” and South Korea’s K-Semiconductor Belt strategy, are providing substantial incentives to localize supply chains and foster innovation. Companies such as Taiwan Semiconductor Manufacturing Company Limited and Samsung Electronics Co., Ltd. are at the forefront, driving demand for cutting-edge metrology solutions to support sub-5nm and emerging 3D packaging technologies.

North America is characterized by its leadership in metrology equipment innovation and the presence of key global suppliers. The United States, in particular, is home to industry leaders like KLA Corporation and Applied Materials, Inc., which are pivotal in developing next-generation inspection and measurement tools. The region’s market dynamics are influenced by the U.S. CHIPS and Science Act, which aims to revitalize domestic semiconductor manufacturing and research. This legislative support is spurring new investments in both fabrication and metrology equipment, with a focus on advanced process control and yield enhancement for leading-edge nodes.

Europe is leveraging its strengths in specialty and automotive semiconductors, with a focus on quality and reliability. The region’s market is shaped by the presence of companies like Infineon Technologies AG and STMicroelectronics N.V., which require precise metrology for power electronics and sensor applications. The European Union’s “Chips Act” is fostering collaboration between research institutions and manufacturers, aiming to double the region’s global semiconductor market share by 2030. This policy environment is encouraging investments in metrology equipment tailored to both mature and advanced nodes, particularly for automotive and industrial applications.

In summary, while Asia-Pacific leads in manufacturing scale, North America excels in innovation, and Europe focuses on specialized applications and quality, collectively shaping the global landscape of semiconductor metrology equipment manufacturing in 2025.

Challenges and Barriers: Supply Chain, Cost Pressures, and Technical Hurdles

The semiconductor metrology equipment manufacturing sector faces a complex array of challenges and barriers as it strives to keep pace with the rapid evolution of chip technology in 2025. One of the most pressing issues is the fragility and complexity of the global supply chain. The industry relies on a highly specialized network of suppliers for precision components, advanced optics, and rare materials. Disruptions—whether due to geopolitical tensions, natural disasters, or logistical bottlenecks—can significantly delay production timelines and increase costs. For example, the reliance on ultrapure materials and custom-engineered subsystems means that even minor supply interruptions can have cascading effects throughout the manufacturing process, as highlighted by ASML Holding N.V., a leading supplier of photolithography systems.

Cost pressures are another significant barrier. The development and production of advanced metrology tools require substantial capital investment in R&D, cleanroom facilities, and precision manufacturing. As device geometries shrink to the single-digit nanometer scale, the need for higher-resolution and more accurate measurement tools intensifies, driving up both development and operational costs. This is compounded by the need for continuous innovation to meet the demands of leading-edge semiconductor fabs, as noted by KLA Corporation, a major player in process control and metrology solutions. Smaller manufacturers often struggle to compete, leading to increased industry consolidation and potential barriers to entry for new firms.

Technical hurdles also loom large. The transition to advanced nodes, such as 3nm and beyond, introduces new measurement challenges, including the need to accurately characterize complex 3D structures, novel materials, and multi-patterned layers. Metrology equipment must deliver not only higher precision but also faster throughput to avoid becoming a bottleneck in high-volume manufacturing. Integrating artificial intelligence and machine learning into metrology systems is essential for handling the vast data generated, but this adds further complexity to system design and validation. Industry leaders like Hitachi High-Tech Corporation are investing heavily in these areas, yet the pace of technological change often outstrips the ability of equipment manufacturers to deliver fully mature solutions.

In summary, semiconductor metrology equipment manufacturers in 2025 must navigate a landscape marked by supply chain vulnerabilities, escalating costs, and formidable technical challenges, all while supporting the relentless drive toward smaller, more complex semiconductor devices.

Customer Segments and End-Use Applications

Semiconductor metrology equipment manufacturing serves a diverse array of customer segments, each with distinct requirements driven by rapid technological advancements and the increasing complexity of semiconductor devices. The primary customers are integrated device manufacturers (IDMs), foundries, and outsourced semiconductor assembly and test (OSAT) companies. These entities rely on metrology tools to ensure precise process control, yield optimization, and compliance with stringent quality standards throughout the semiconductor fabrication process.

IDMs, such as Intel Corporation and Samsung Electronics, integrate design, manufacturing, and testing under one roof, necessitating advanced metrology solutions for in-line process monitoring and defect detection. Foundries, including Taiwan Semiconductor Manufacturing Company Limited (TSMC) and GLOBALFOUNDRIES Inc., manufacture chips for fabless companies and require metrology equipment capable of handling high-mix, high-volume production environments. OSAT providers, such as Amkor Technology, Inc., focus on the back-end assembly and testing, utilizing metrology tools for package inspection and reliability assurance.

End-use applications for semiconductor metrology equipment are broad and evolving. The most significant demand comes from logic and memory device fabrication, where shrinking node sizes and 3D architectures (e.g., FinFETs, 3D NAND) require precise measurement of critical dimensions, film thickness, and overlay accuracy. The automotive sector is an emerging application area, as advanced driver-assistance systems (ADAS) and electric vehicles (EVs) drive demand for high-reliability semiconductors, necessitating rigorous metrology for defect control and traceability. Consumer electronics, including smartphones and wearables, continue to be major end-users, pushing for higher performance and miniaturization, which in turn increases the need for advanced metrology solutions.

Additionally, the rise of artificial intelligence (AI), 5G, and Internet of Things (IoT) applications is expanding the scope of metrology requirements, as these technologies demand heterogeneous integration and new materials. As a result, semiconductor metrology equipment manufacturers must innovate to address the unique challenges posed by advanced packaging, compound semiconductors, and emerging device architectures, ensuring their solutions remain relevant across a dynamic and expanding customer base.

Future Outlook: Disruptive Technologies and Strategic Opportunities (2025–2030)

The period from 2025 to 2030 is poised to be transformative for semiconductor metrology equipment manufacturing, driven by disruptive technologies and evolving strategic imperatives. As device geometries shrink below 2nm and heterogeneous integration becomes mainstream, the demand for advanced metrology solutions will intensify. Key disruptive technologies include the integration of artificial intelligence (AI) and machine learning (ML) into metrology systems, enabling real-time data analysis and predictive maintenance. These advancements are expected to significantly enhance process control and yield, particularly as chipmakers push the limits of extreme ultraviolet (EUV) lithography and 3D device architectures.

Another major trend is the development of hybrid metrology platforms that combine multiple measurement techniques—such as optical, electron, and X-ray methods—within a single tool. This approach addresses the increasing complexity of materials and structures in advanced nodes, offering comprehensive characterization capabilities. Leading manufacturers like KLA Corporation and Hitachi High-Tech Corporation are investing heavily in such integrated solutions to meet the stringent requirements of next-generation semiconductor fabrication.

Strategically, the industry is witnessing a shift toward closer collaboration between equipment suppliers, chipmakers, and materials providers. This ecosystem approach accelerates innovation cycles and ensures that metrology tools are tailored to the specific needs of advanced process nodes. Initiatives led by organizations such as SEMI are fostering standardization and interoperability, which are critical for scaling new technologies across global supply chains.

Geopolitical factors and supply chain resilience will also shape the future landscape. Governments in the U.S., Europe, and Asia are increasing investments in domestic semiconductor manufacturing and R&D, creating new opportunities for metrology equipment suppliers to localize production and collaborate on next-generation technologies. For instance, the U.S. Department of Commerce and the European Commission have launched initiatives to bolster semiconductor ecosystems, which include support for advanced metrology infrastructure.

In summary, the next five years will see semiconductor metrology equipment manufacturing at the forefront of technological disruption and strategic realignment. Companies that leverage AI-driven analytics, hybrid metrology, and collaborative innovation will be best positioned to capitalize on the opportunities presented by the rapidly evolving semiconductor landscape.

Conclusion and Strategic Recommendations

The semiconductor metrology equipment manufacturing sector stands at a pivotal juncture in 2025, shaped by rapid technological advancements, increasing device complexity, and the relentless drive toward smaller process nodes. As chipmakers push the boundaries of Moore’s Law, the demand for precise, high-throughput, and non-destructive metrology solutions has never been greater. Leading manufacturers such as KLA Corporation, ASML Holding N.V., and Hitachi High-Tech Corporation continue to innovate, integrating artificial intelligence, machine learning, and advanced optics into their metrology platforms to address the evolving needs of the industry.

Strategically, companies in this sector should prioritize the following recommendations to maintain competitiveness and capture emerging opportunities:

- Invest in R&D for Next-Generation Nodes: With the transition to sub-3nm and even smaller geometries, metrology equipment must deliver higher resolution and accuracy. Continuous investment in research and development is essential to support advanced process control and defect detection.

- Expand Collaborative Ecosystems: Forming strategic partnerships with semiconductor foundries, integrated device manufacturers, and research consortia such as imec and SEMI can accelerate innovation and ensure alignment with industry roadmaps.

- Leverage Digitalization and AI: Integrating AI-driven analytics and digital twins into metrology systems can enhance predictive maintenance, process optimization, and yield improvement, providing significant value to customers.

- Address Sustainability and Cost Efficiency: As environmental regulations tighten, manufacturers should focus on energy-efficient designs and sustainable materials, while also optimizing cost structures to remain competitive in a price-sensitive market.

- Global Supply Chain Resilience: Diversifying supply chains and investing in local manufacturing capabilities can mitigate risks associated with geopolitical tensions and supply disruptions.

In conclusion, the semiconductor metrology equipment manufacturing industry in 2025 is defined by both unprecedented challenges and opportunities. By embracing innovation, fostering collaboration, and prioritizing sustainability, manufacturers can secure their position at the forefront of this critical sector, enabling the continued advancement of the global semiconductor industry.

Sources & References

- KLA Corporation

- ASML Holding N.V.

- Hitachi High-Tech Corporation

- Onto Innovation Inc.

- Onto Innovation Inc.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Amkor Technology, Inc.

- European Commission

- imec